nj ev tax credit 2021

Light duty electric truck. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

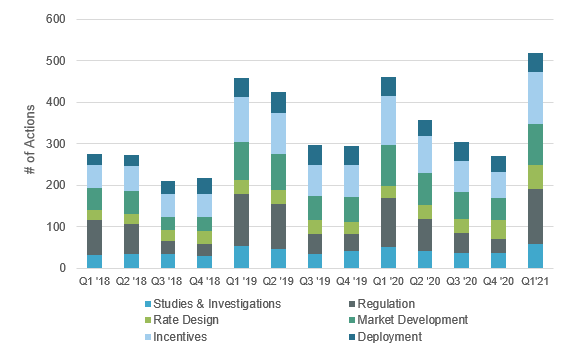

Legislation Regulations Evadoption

The incentives could be combined with a current federal tax credit to potentially bring the sticker price of a 40000 electric vehicle for example into the 28000 range.

. The exemption is NOT applicable to partial. The deadline to order purchase or lease an eligible electric vehicle was Wednesday September 15 2021. SEA Autocar ACMD 7 EV ACMD 8 EV Expeditor EV MD HD Battery SEA Electric LLC.

Increasing the use of electric vehicles is a critical step to secure New Jerseys clean energy future Murphy said. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. 5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model year.

SEA Ford E-450 EV F-53 EV F-59 EV F-150 EV F-450 EV F-550 EV F-650 EV F-750 EV MD HD Battery SEA Electric LLC. EV tax credit for new electric vehicles Current EV tax credits top out at 7500. Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives. Those with a manufacturers suggested retail price from 45000 to 55000 receive a 2500 incentive.

With that law the state now offers 5000 rebates to eligible customers to purchase electric vehicles along with previous provisions giving tax credits to purchase zero-emission vehicles and. New Jersey has emerged as a national leader in this market offering rebates of up to 5000 cash for eligible electric vehicles. Audi 2021 e-tron 222.

Charge Up New Jersey promotes clean vehicle adoption in the state by offering incentives of up to 5000 for the purchase or lease of new eligible zero-emission vehicles including. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. New Jersey earned a high ranking after it passed a 2019 law with added incentives for using electric vehiles according to the Plug in America analysis.

SEA Freightliner Cascadia EV Econic EV M2 106 EV MB65 EV MT45 EV MT55 EV S2 EV S2 C EV MD HD Battery SEA Electric LLC. 10 discount on the off-peak rate for the New Jersey Turnpike and Garden State Parkway. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of their cars depending on the make and model.

The credit amount will vary based on the capacity of the battery used to power the vehicle. The vehicle in question must be purchased new - it cannot be used andor leased for you to receive the credit. Plug-in Electric Vehicles PEVs which are growing in popularity enable drivers to take advantage of a new vehicle technology that can save energy and money while having a positive impact on our environment and economyPowered by electricity these vehicles are recharged at home or at public charging stations at a fraction of the current.

If youre ready to find your vehicle use the search below. 07 2021 535 pm. The Order establishes minimum filing requirements for light-duty EV infrastructure proposals from New Jerseys electric utilities and requires them if they have not done so already to submit these filings by February 28 2021.

Electric vehicles are qualified to receive reduced toll rates via the Green Pass Discount through their EZ Pass accounts. New Jerseys Energy Master Plan outlines key strategies to reduce energy consumption and emissions from the transportation sector including encouraging electric vehicle adoption electrifying transportation systems leveraging technology to reduce emissions and miles traveled and prioritizing clean transportation options in underserved communities to reach the. The Charge Up New Jersey Program has been successful for the second year in a row.

Qualified Plug-In Electric Drive Motor Vehicles IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Sabtu 19 Maret 2022 Edit. But when combined with the federal tax credit of up to 7500 EV drivers in the Garden State can.

4200 0 You Save 3010 33745 BMW 2019 i3. Nj Tesla Tax Credit 2021 - Electric Cars For Everyone Not Unless They Get Cheaper The New York Times Volkswagen id4 250. Credits are reduced and eventually phase out after a.

NJBPU had released a Straw Proposal in May that. Rebates vary based on vehicle purchase price the vehicles US. The deadline to order purchase or lease an eligible electric vehicle was Wednesday September 15 2021.

0 You Save 3776 49500. The credit is worth 2500 to 7500 depending on the cars battery capacity. Combined with the federal tax credit of up to 7500 ev drivers in the garden state were getting as.

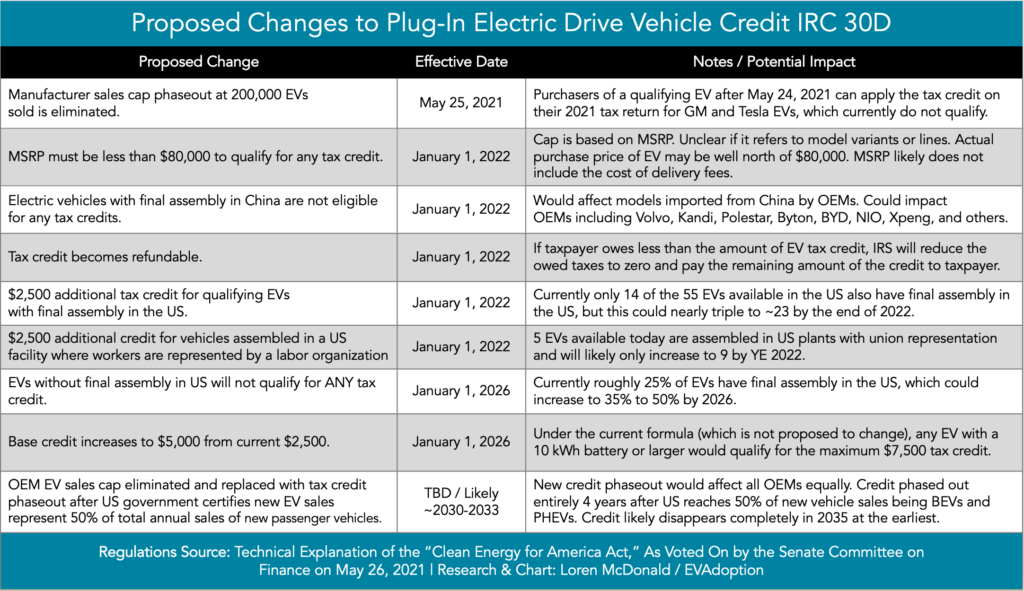

The New Jersey Board of Public Utilities NJBPU Charge Up New Jersey program offers point-of-sale rebates to New Jersey residents for the purchase or lease of a new light-duty EV. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Medium duty electric truck.

Plug-in Electric Vehicles. NJBPU Launches Year 2 of Popular Charge Up New Jersey Electric Vehicle Rebate Program 0762021 Beginning Today Customers Can Receive up to 5000 Incentive at the Point of Purchase. Heavy duty electric truck.

The Charge Up New Jersey Program has been successful for the second year in a row. Another important rule to keep in mind is that the federal tax credit cannot be passed. Heres a glance at some of the fine print.

0 0 You Save 4366 58400 Audi 2021 e-tron sportback. BMW 2020 i3 REX 168-223. Environmental Protection Agency-rated all-electric range are available in the following amounts.

For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity. Customers must enroll in the plan and provide proof of eligibility. New Jersey just restarted its electric vehicle incentive program.

Light duty passenger vehicle. To apply call New Jersey E-ZPass at 1-888-AUTOTOLL 1-888-288-6865. Beginning on January 1 2021.

New Jersey Solar Incentives Nj Solar Tax Credit Sunrun

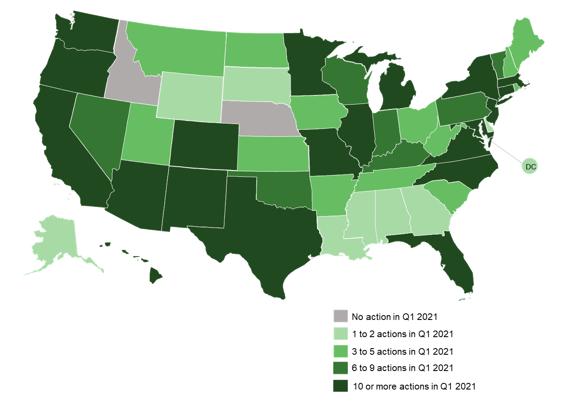

The 50 States Of Electric Vehicles State Lawmakers Focus On Incentives Fees And Government Procurement In Q1 2021 Nc Clean Energy Technology Center

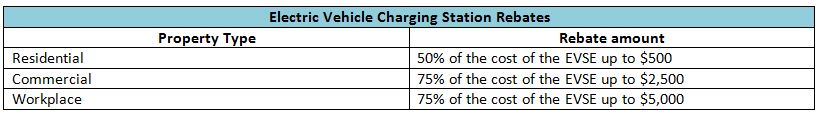

Rebates And Tax Credits For Electric Vehicle Charging Stations

A Perspective On Equity In The Transition To Electric Vehicles Mit Science Policy Review

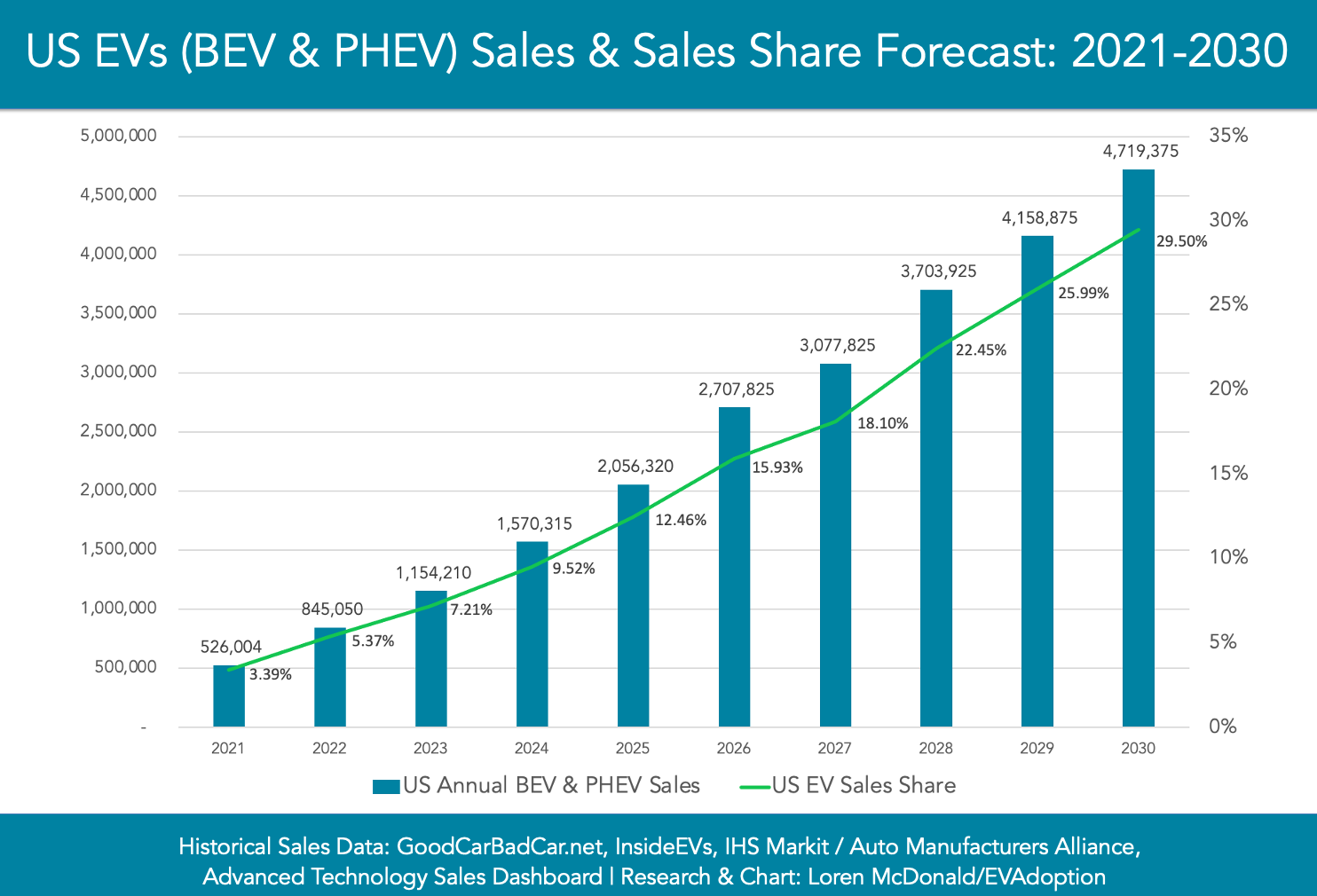

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Latest On Tesla Ev Tax Credit March 2022

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The 50 States Of Electric Vehicles State Lawmakers Focus On Incentives Fees And Government Procurement In Q1 2021 Nc Clean Energy Technology Center

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Rebates And Tax Credits For Electric Vehicle Charging Stations

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Southern California Edison Incentives

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore